If you are starting a startup and find yourself spinning your wheels with seemingly unimportant details and therefore can’t get any “real” work done, you’re not alone. If you’re like me, you feel overwhelmed with tasks that don’t appear to provide a return on your time investment. For example, I spent two hours buying a new printer because the one I bought nine months ago doesn’t work anymore, and the company’s support desk says I need the receipt, but I don’t have the receipt…you get the idea. Sheeeez – that’s two hours of my life I’ll never get back during which I could’ve been calling prospects or marketing or something. This story happens to all of us.

Posts Tagged ‘founder’

Thoughts for entrepreneurs from someone who's been in the trenches.

Four Revenue Growth Challenges Within My Angel Portfolio

On August 2, 2016, I posted “13 Observations from a Part-Time Angel Investor.” Since then, I’ve invested in three new startups, making eight total investments. Here is an update of their progress.

The Five Essential Commonalities for the Entrepreneurial Spirit

What does it take to be successful starting an innovative company? While writing The Hockey Stick Principles, I identified five fundamental elements of what I’ll call the “entrepreneurial spirit” that seem to be those that are most important in allowing founders to make it through the confusing, chaotic building process: Read More

Does Dr. Evil’s “Virtucon” Offer a Realistic Leadership Model?

Dr. Evil, the menacing, quirky character in the 1997 spoof “Austin Powers: International Man of Mystery” literally builds an empire in his sleep. The scene plays out when Dr. Evil introduces his associate, “Number 2” (the man with the eyepatch), who runs Virtucon, the legitimate face of his evil empire. Using miniature models on a map of the U.S. that light up, Number 2 shows Dr. Evil the enormous, successful businesses he has built while Dr. Evil was asleep for 30 years. Could you do the same with your own startup? Could you hire a Number 2 and just sleep?

How the New Tax Plan Will Affect Startups

The newly proposed tax bills are making their way through the House and Senate. Let’s look under the hood and find out how they may affect your startup. I’ll be breaking down the main changes by Read More

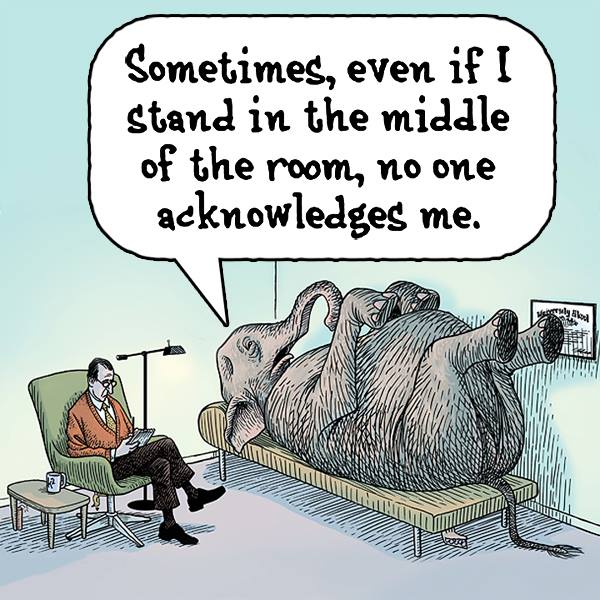

Why Can’t You Make It Work with Spaghetti?

In which convincing buyers of your value proposition is maddening…and what to do about it.

When researching The Hockey Stick Principles, I felt that the founder of software firm Sageworks, Brian Hamilton, was the most profound with his explanations for startup challenges. Especially thoughtful was his analogy for how difficult it is to convince customers of your new idea: Read More

Doing Things Badly

“If a thing is worth doing, it is worth doing badly.” —G. K. Chesterton

I learned the hard way just exactly what this weird quote means. In 2007, my salesperson-friendly industry research company, First Research, was sold to Dun & Bradstreet for $26.5 million. But early on in the life of First Research, my fledgling company was in a sad state.

When First Research was initially formed in 1999, I was a burned-out 29-year old banker with little business experience. What I did have was a novel idea for an online product that would help salespeople quickly prepare for calls by researching their prospect’s industry, and on April 15, 1999, after quitting my day job, First Research opened for business. Eight months later, our progress was as follows:

When First Research was initially formed in 1999, I was a burned-out 29-year old banker with little business experience. What I did have was a novel idea for an online product that would help salespeople quickly prepare for calls by researching their prospect’s industry, and on April 15, 1999, after quitting my day job, First Research opened for business. Eight months later, our progress was as follows:

- First Research had one customer, far from the 25 customers I had forecasted in my plan.

- First Research had produced 40 Industry Profiles, far from the 170 I had anticipated.

- I had no concrete evidence that anyone wanted our product. While several bankers thought our product was interesting and helpful, I was at a stalemate in terms of their commitment and willingness to sign on the line which is dotted.

- I hadn’t pinpointed a market for prospective buyers. I had planned to sell to banks, but limited success with them had me experimenting with other types of buyers, who also were not interested.

- Maintaining our product had become more work than originally planned. We hired a part-time MBA student to help. The first two students didn’t work out – one quit and one I had to let go. I thought, “If I can’t hire and manage for this simple job, how will I one day hire and manage dozens of employees?“

- To find some personal income and make ends meet, I was spending precious time completing one-off research projects for companies instead of selling First Research. This wasn’t in my business plan.

- Some people were not taking my idea seriously. One banker told me, in a deep Southern accent, “Bobby, we’re the bank; this is already what we do. I don’t want to see you get in too deep with this sil-lee thing, son.” (Calling me “son” was almost more than I could take.)

I truly believed that my company had tremendous potential, but despite my best efforts–as G.K. Chesterton summarized in his quote–until I learned from trial and error, I was doing things badly.

The lowest point in the early days of First Research was the result of a simple mishap. I worked out of a home office, and I had this a 8 ½ x 11 sheet of paper hung on the wall with a handwritten reminder: “Thousands will Pay a Thousand Dollars for First Research.” The mini-poster actually meant a lot to me because it was my source for hope. But when a friend was visiting, he noticed, laughing hysterically, that I had made an error and spelled it ReRearch. I thought that mistake was symbolic that perhaps it was time to throw in the towel.

But I didn’t. I hung in there and made a few decent sales the next year and managed to eventually build a real business–a $26.5 million business.

From my own experience as well as talking to hundreds of other successful founders, I’ve found these “badly done things” are often par for the course.

The Most Important Lesson I Learned from Revel Systems’ Lisa Falzone

While writing The Hockey Stick Principles, I interviewed dozens of founders. This blog is part of a series, “The Most Important Lesson I Learned from…” Look out in the coming weeks for others like this one.

Lisa Falzone, age 31, is cofounder and CEO of hugely successful retail point-of-sale system Revel Systems. She is quick-minded, candid, and matter-of-fact in conversation. Lisa, a Stanford grad, spent much of her twenties unhappily working for corporations. A former collegiate swimmer, Lisa notes, “My passion in life was to race. When I stopped swimming, I was pretty lost. I knew I had to find that passion with work somehow.” Read More

1-Minute Rant: “How to Create Like Seinfeld”

Jerry Seinfeld once explained how it takes him months to turn a joke idea into a hilarious observation. A startup idea works in a similar manner. It takes years to really turn your idea into a viable business. Learn how to create like Seinfeld in this week’s 1-Minute Rant. Read More

The 6 Reasons I Kept My Startup Going

This is a follow-up from last week’s post, “Doing Things Badly,” which recounts the first year of starting First Research, my first company, which was eventually sold to Dun & Bradstreet for $26.5 million.

First Research struggled during that first year. On paper, it was failing. Year-end 1999 revenue was just shy of $4,000. We had $399 in cash, $899 in accounts receivable, and a $20,150 loan payable to me. So even nine months into the venture, we had almost nothing to show for it. I was approaching that crossroads many people experience after a year of starting a new business: Should I keep going with First Research? Since I was unable to answer that question, I kept fighting with no stopping-point in mind. The six reasons I kept on were as much psychological as they were empirical.

First Research struggled during that first year. On paper, it was failing. Year-end 1999 revenue was just shy of $4,000. We had $399 in cash, $899 in accounts receivable, and a $20,150 loan payable to me. So even nine months into the venture, we had almost nothing to show for it. I was approaching that crossroads many people experience after a year of starting a new business: Should I keep going with First Research? Since I was unable to answer that question, I kept fighting with no stopping-point in mind. The six reasons I kept on were as much psychological as they were empirical.

First, First Research was about so much more than a business – it was a crutch to buoy my emotions after three crushing failures: My long-time girlfriend had just dumped me; before starting my business, I had been passed over for a bank manager job; and I found myself sitting on the bench while playing soccer for a local semi-professional team. In a frustrated state of near wall-to-wall failure, I wasn’t interested in failing again. And I was not a rational investor–a $500 check made me feel rich. Thus, my desire to keep First Research going was more emotional than logical.

Second – I was motivated by a “me-against-the-world” mentality. I enjoyed playing the underdog because it confirmed my belief that I wasn’t supposed to be successful; therefore, I had nothing to lose. So why not give it everything I had? Managers holding me accountable or requiring that I do something had hardly motivated me. Instead, I was motivated by my own “inner manager” daring me: “This is a big challenge, Bobby; can you figure it out?”

Third – I loved trying to make something work that had never been done before. Somewhere in my DNA is the microchip, “Wants to build new concepts.” When I woke up every morning, creating something gave me a sense of wonder. My cofounder, Ingo Winzer, later told me, “After a year, we still didn’t know if we had a business. That didn’t matter to me. By then I was pretty confident something good would happen, mainly because you were so excited about what we were doing. I think every new business needs that–infectious enthusiasm. Just having a good idea isn’t enough.”

Fourth – my sixth-sense confidence told me that my idea was a good one. Common sense told me that a salesperson needed to understand a customer’s business before a meeting. Almost every sales guru in the country was preaching sales-call preparation and understanding the customer’s business. And from my own first-hand experience as a banker, I was confident that First Research was an effective new tool. I only needed patience and execution to convince others.

Fifth – I wanted to finish the puzzle. Parts of the puzzle, like product enhancements and reaching new customers, were yet to be pieced together. You can’t start a puzzle and not finish it. Putting its pieces together was fun and absorbing. Every time Ingo and I matched a puzzle piece, we created that wonderful feeling of accomplishment for ourselves.

And last – Ingo and I never defined failure. For example, we never decided that $4,000 in sales during the first year was an indication of how we had performed. We never talked about when or why we would quit because it wasn’t an option. We felt successful because we were in the game.

So Ingo and I just buckled down and did our thing. I woke every day and asked myself, “How can I convince someone to buy our amazing product?” And Ingo woke up every day and asked himself, “How can I write an industry profile that will blow the socks off our customers?” And that became our fight: it was simple, precise, restricted in scope, energetic, and elegant.

Not taking outside investors enabled Ingo and me to have this simple mentality. An outside investor would have likely become impatient and frustrated by our inability to meet our business plan goals. Spending only the money we needed to get the product going kept us focused. Without investors, Ingo and I didn’t need to continuously satisfy someone else or waste our time explaining our failures—we simply recalibrated and fixed the mistakes. My lack of business experience was never a question because we were stuck with me—no hiring/firing quandaries there!

And so the fight went on.

1-Minute Rant: “Gettin’ Dirty”

Think about what we know about how Steve Jobs managed Apple. Read More

King Solomon’s Wise Advice for Startup Founders

One of my favorite books in the Bible is Ecclesiastes. Written by Solomon, the King of Israel, it discusses life’s true meaning. Despite being written 3,000 years ago, it applies amazingly well to startup founders today. King Solomon had it all. Read More

“Fifty Ways to Leave Your Lover” & Other Embarrassing Startup Moments

Let’s not take ourselves… or our businesses… too seriously

Once when travelling who knows where, who knows when, who knows why–a young flight attendant was taking us through the safety precautions and says, “There may be fifty ways to leave your lover, but there are only four ways to exit this aircraft.” Ahhhh, clever– throw in some Paul Simon lyrics. I like.

The flight attendant strolls by me, and I exclaim, “You just slip out the back, Jack!” No reaction. She strolls by again, I add, “You don’t need to coy, Roy!” No reaction. A few minutes later, “Just drop off the key, Lee!” Nothing. At this point, I’m not even trying to be funny; I’m just looking for some sort of reaction. The flight attendant eyes me as if I’m crazy. The man seated behind me is belly laughing – so I believe this exchange is somehow funny. But she’s not amused and instead is clearly irritated. Now I’m just confused.

The man behind me finally explains why he’s laughing: “She’s only 25 years-old and has no idea what you’re talking about. She’d probably heard another flight attendant use the phrase ‘50 ways to leave your lover…’ and so she copied it.”

I tried to explain myself to the flight attendant, but the damage was done. The more I tried to clarify what had occurred, the less she cared and the more awkward the situation became. Passengers are just shaking their heads.

Truth be told, I’ve done some pretty stupid, silly, embarrassing things during the time I founded two companies. Here’s a partial list:

- I inadvertently sexually harassed the sexual harassment trainer (that story is for another blog post).

- I broke my assistant’s nose playing an impromptu soccer kick-around.

- At a cocktail party meet-and-greet with customers at a very nice restaurant, I showed everyone in the room my geographic tongue.

- I requested my salesperson and intern help me clean my house in exchange for pizza. What was I thinking? This one became legendary.

- I once went postal on a few customers – shocking the room.

If you are a startup founder, I recommend you make your own list. How many times have we heard someone tell a work story that makes their boss sound like a complete moron (think: Michael Scott from The Office)? The reality is that, as a startup founder, embarrassment and vulnerability are inevitable. Best to go with it—laugh about it, be yourself, and enjoy the ride.![]() Tweet this

Tweet this

I would never trade these stories and red-faced embarrassments for anything. The stories are a culmination of who I am and how I remember my startup experience. What would be sad would be looking back at eight years of me trying to become something I’m not. I could never be the CEO of a large publicly traded business; my personality would never lend itself to the necessary political correctness. But I can successfully create a positive atmosphere and grow a thriving small business by simply being myself.

So as Paul Simon advises, “’The problem is all inside your head,’ she said to me; The answer is easy if you take it logically…” Sometimes the problem is easy – Just don’t take yourself too seriously. You’ll be amazed by how much more fun your startup culture will become.

1-Minute Rant: “5 Tips to Improve Working with Contractors”

Just about all founders must work with contractors to get stuff done. We simply don’t have the time or skills to do it all. Read More

Founders Should be Called “Flounders”

According to Dictionary.com, to flounder is to struggle clumsily or helplessly. Flounder is the perfect word to describe the process of starting a startup. In the beginning, the founder feels just like that – like a fish out of water, a “flounder” maybe, flopping along the ground after being hooked by a fisherman. Read More

Giving Credit Where Credit is Due

If you are the founder of a startup, have you given thought to what…or who…set you on your entrepreneurial path? I certainly have, and there is one name at the very top of that list…

Throughout most of school, I was a lousy student. In fact, my lack of maturity and short attention span led to my “repeating” fourth grade. I was hyperactive, and if I were a kid today, doctors would put me on Ritalin. According to my father, experts told him I’d never graduate from high school much less go to college. I could easily have hit the skids.

I’m unsure when I turned the corner to actually try in life, but I’m pretty sure I know who had the most influence. He’s the person I owe the most to in terms of my becoming an entrepreneur and having a fulfilled, engaging career. Don Goodwin, my high school American history teacher, practically danced across the room, engaging students from the front to the back. He loved American history, and his passion for the subject helped me come alive, opening my mind to a love for learning. He was tall and lanky, wore cool glasses, and was a charismatic, confident outsider who humorously mocked sports events, proms, cheerleaders, spring break, student government, and pop culture.

The mediocre teacher tells. The good teacher explains. The superior teacher demonstrates. The great teacher inspires. –William Arthur Ward

Yet Mr. Goodwin was an independent thinker in a highly productive way, instilling in me a sense of optimism and confidence that one can be different and still be relevant in a conventional setting. No need to be a conformist if you didn’t want to. His energy was contagious, and I ate it up more than anything I ever had experienced. I never knew that Thomas Jefferson and the Louisiana Purchase could be so interesting!

Sure, Mr. Goodwin was smart and articulate, but that’s not what made him influential. Rather, it was his coming alive with his subject matter in a quest for something greater. He excelled at his craft mostly because he liked it so much. It was from Mr. Goodwin that I first learned some of entrepreneurship’s most critical ingredients – passion for your idea and whatever is your “thing,” and genuinely caring about people.

My point of telling you this story is that if today, you’re happy with your career and doing things you love—think hard about who helped you get to that point. And be sure to thank them.![]() Tweet this

Tweet this

I was fortunate enough to hunt down Mr. Goodwin, have a beer with him, catch up on life, liberty, and the pursuit of happiness—and thank him. I also provided him an advance copy of my upcoming book, The Hockey Stick Principles, which is dedicated to him.

Who inspired you on your path to entrepreneurship?

What did they do or say to light a fire in your belly?

1-Minute Rant: “Think Hard About How You Pitch Your Idea”

When I was starting my first company First Research, I was down-right awful at explaining my idea. Read More

1-Minute Rant: Health Insurance Costs are Killing Startups

In 1999 when I started First Research, if I had to purchase family health insurance at today’s prices, it would have cost me at least $2,000 per month – about as much as my entire monthly budget. I never could have afforded that; therefore, First Research would have never been started at all. Costs for purchasing health insurance are out of control, and it’s hitting startups hard. Hear me out! Read More

Twelve Reasons Selling Your Company Is a Bad Idea

It’s been nearly 10 years since I sold First Research for $26 million to Dun & Bradstreet. Do I regret doing so? It is a complex question, but let’s just go with YES. Here is why I encourage founders to think twice before selling their company:

- When you’re selling your business, you’re selling your passion: The words of one founder who made a great sale for his start-up especially resonate for me. Roger Bryan, who started Enfusen Digital Marketing, eloquently told mashable.com in an interview about his thoughts on the transaction, “I spent six years building the first company I sold. The day that I sold it was one of the greatest accomplishments of my life. . . .Then as each month went by, and the money sat in my bank account as I tried to figure out what to do next, the regret started to set in. I hadn’t sold my company; I had sold my passion.” Many founders feel a deep sense of remorse once a sale is complete, even if they have made a truly great deal.

- Most of the time, your “company” will becomes a “product”: Large businesses don’t normally maintain multiple independent departments for each product they sell. They already have a sales force, finance, and management – so why would they need those functions for your product? Cutting those duplicate expenses is one way mergers are profitable. The result is the destruction of the company you built.

- Merger negotiations are stressful: Selling your company is a full-time job – and keep in mind that you already have a full-time job managing your company that must maintain its current growth rate, which is probably fast. Life’s too short – trust me.

- Integration is stressful: Combining two organizations is like merging together two families. It’s a hellish two-year during which the acquiring firm must guess about which new business processes will work and which ones won’t. The stress is guaranteed to put gray hair on your head.

- Your employees often lose out: The first year after a merger, your employees are uncertain whether or not they’ll be fired—stressing everyone out. They’re told by the acquiring firm how “valuable” they are. But one important caveat—they aren’t told that they are only “valuable” for the first year or two after the merger. Screw that torture!

- The strategic fit between two companies can’t be known until they’re put together: The truth is that the acquiring company is only guessing about how successful integration will go – and they may have delusions of grandeur. Don’t assume that because a company is large and employs a bunch of MBAs and CPAs that they can foresee the future. Mergers are risky.

- You’ll be going through a not-so-great life-change: When I sold my company, I ended up with so much stress from integration and from losing something that I loved that I was visiting a psychologist and doctors to check my overall health. These stories don’t happen every time someone sells his or her company, but my research shows it happens quite often.

- You’ll probably want to rebuild what you already had: After selling their company, many founders, like myself, start a similar one all over again. To do that, you’ll have to grind out building a new business from scratch a second time.

- Having lots of money is overrated; owning a growing company is underrated: Just this morning, I was barking at the employees of my “yard irrigation company” because the system isn’t working properly and my expensive plants are dying. To my mind, that’s no way to live. Having lots of money is sort of cool, but having a high-energy growth company with a good culture is really, really cool!

- If you have a successful company, then you should have already earned money: Too many founders operate their company’s “breakeven” by investing all their operating profit into growth to increase their company’s valuation. Unless you are the next Amazon, why not pay out a reasonable percentage of profit as a dividend?

- It’s doubtful you’ll become “corporate jet rich” anyway: Corporate jet rich means you can afford several hundred thousand a year just for your jet. Ninety-nine percent of founders who sell their companies aren’t going to obtain that kind of wealth, so just keep your company and be happy with what you already have.

- Founders grow companies better than outsiders: A 2006 study showed that the average return on stocks of the 26 Fortune 500 firms run by founders was 18.5 percent annually from 1995 to 2005, which was seven percentage points better than the Fortune 500 average in those years. A 2010 study reported that “founding CEOs consistently beat the professional CEOs on a broad range of metrics ranging from capital efficiency (amount of funding raised), time to exit, exit valuations, and return on investment.”

The value of the satisfaction of guiding the long-term success of your company cannot be measured. When you sell out, you’re trying to quantify your creation, which doesn’t logically work. Ben Horowitz agrees in The Hard Thing About Hard Things, noting how the logical part is easy: “One of the most difficult decisions that a CEO ever makes is whether to sell her company. Logically, determining whether selling a company will be better in the long term than continuing to run it stand-alone involves a huge number of factors, most of which are speculative or unknown. And if you are the founder, the logical part is the easy part.”

To gain more valuable insight and perspectives about selling your business, check out John Warrillow’s podcast series Built to Sell Radio, a collection of well-organized interviews from founders who have sold their company. The best book on the subject is Finish Big by business writer Bo Burlingham.

By the way, I never could come up with 12 reasons you should sell your business. I’m just sayin’.

The One Thing that Prevents Most Startups from Succeeding

Why do so many startups struggle getting off the ground?

First, let’s begin with their products. Most new products are incomplete (explained in Geoffrey Moore’s excellent book, Crossing the Chasm); they lack features that users expect; they have no brand name recognition; their teams are “two guys and a dog”; the problem the product is solving is yet to be obvious to most buyers; they don’t have competitors to validate their value. Read More

1-Minute Rant: My Solution to Reduce Health Care Costs

Health care costs are out of control. Here is one of the solutions on how I’d go about fixing this problem that is crippling startups. Read More

Build Your Very Own ATM Machine

Why too many startups aren’t paying dividends, but should be.

Dividends are considered “uncool” in the startup community. Most founders think they’re for boring, mature companies like utilities and banks. Executive editor of CNET Roger Cheng explains: “For most companies, paying a dividend is the ultimate admission that the growth phase (also known as the fun period) is over.”[i]

But wait! I know a startup that has millions in revenue and pays out 80 percent of it to its owners. (No typo here – they dividend 80 percent of revenue). Yet it still grows 20 to 30 percent each year. Can you imagine how much these founders earn each year?

Kickstarter is also paying dividends. Fred Wilson from Union Square Ventures says, “I did the math, and I thought about it, and I concluded that there was going to be a lot of cash flow, potentially, to dividend out.”[ii] Another company that believes in earning its owners profits instead of operating breaking even is $3.2 billion SAS Institute, whose cofounder, Jim Goodnight, explained in Forbes: “We were profitable the first year, and we’ve been profitable for 38 years since… That’s one of the goals – to make sure we always stay profitable.”[iii]

While these startups are unusually profitable, it is possible to run your business with a similar mentality. Let’s look at a typical scenario of a startup that has developed a niche market. Let’s say you and a cofounder start a company and you each invest $50,000. By the fifth year, your revenue is $1.5 million, but instead of spending $1.5 million in order to grow faster, you retain $250,000 by choosing to spend $1.25 million (16.7 percent operating margin). You choose to pay a $200,000 dividend, so now you’ve recovered all your original investment plus socked away some money in your company’s savings. Each year going forward, you continue maintaining 16.7 percent operating margins, 30 percent growth rates, and paying 80 percent of profits in dividends. After eight years of doing that, you’ll have paid out $6.5 million in dividends while still owning a company with $12 million in revenue. Not a bad gig. And keep in mind, you’ve been collecting a salary each year as well.

My own startups have paid dividends, so I’ve learned a thing or two about them. Here are some tips:

- Don’t pay dividends before you’re ready: Every situation is different, but as a rule of thumb, once you have a consistent, steady flow of new, happy customers for two to three years and have more than a million in revenue, then you can consider dividends. Before that point – better stick to reinvesting cash back into the business.

- Don’t forgo mission-critical projects just to pay a dividend: Never feel the need or obligation to pay a dividend every year. Remember, you aren’t a publicly traded company that should never decrease its dividend without hell to pay. Balance carefully taking good care of your business first, and paying dividends second.

- Have the discipline to say “Next year!”: Your business will always have a backlog of projects to spend newly earned cash on. Instead of always saying yes to them, figure out which ones are necessary and delay the others.

- Dividends aren’t for all startups: If you’re the next Google, Amazon, or Facebook and chasing a multi-billion-dollar market, then maybe you should raise venture capital and invest 100 percent of newly acquired cash into growth. Dividends are best-suited for niche markets that have steady growth, but not off-the-charts revenue potential, or game-changing ideas.

- Speak to your accountant before paying dividends: I use the term “dividends” generically for taking cash out of your business. Ask a CPA to tell you the most tax-efficient method to do that based upon your own tax and financial situation.

You might be thinking right now about college or high school finance classes that dictate the net present value of cash is worth way more in your business growing 20 to 30 percent than sitting in a bank earning 0.5 percent. True. But don’t forget the proverb that a bird in the hand is worth two in the bush. And you only live once also comes to mind, so enjoy the fruits of your labor. Don’t wait for that huge exit (that often never comes) to get a return on your risk and hard work. Instead, enjoy the benefits of hockey stick revenue growth on your own terms.

[i] http://www.cnet.com/news/why-technology-companies-loathe-dividends/

[ii] http://washpost.bloomberg.com/Story?docId=1376-O8X5876JTSEI01-66OREETR931R8I4BM5JQM72L53

[iii] http://www.forbes.com/sites/peterhigh/2014/05/12/an-interview-with-the-godfather-of-data-analytics-sass-jim-goodnight/#674d53b50424

1-Minute Rant: “Pitch Perfect”

One of my favorite arcade games growing up was Galaga. I dominated, but the coolest part was at the end it told me the percentage of shots hit versus missed. Read More

1-Minute Rant: Three Tax Tips for Startup Founders

In this rant, I tell a story about how a friend of mine had to pay the IRS thousands of dollars unnecessarily that nearly broke him. Here are my three tips on how to avoid these tax pitfalls when starting your own startup. Read More

Five Reasons Selling My Startup Was a Good Idea

A few weeks ago, I implored you to second-guess selling your company in my post “12 Reasons Selling Your Business is a Bad Idea.” But I may have missed the mark a little when I said, “Your employees often lose out.” I failed to mention how my first company’s employees fared in the end. Of the 40 employees of First Research, 10 company alumni have founded five new companies, all successful. And, if you add up their revenues, it’s a bigger number than First Research’s revenues in 2007, the year we sold. They must have thought, “If Bobby can start a successful company, then I know I can.” Turns out, they were correct, and they are among the five reasons I’m glad I sold my first company.

- Local Market Monitor: In 2009, Ingo Winzer and Carolyn Beggs reintroduced Ingo’s brilliant home price forecast models. Today, banks, mortgage firms, and home construction companies are subscribers. Ingo is regularly quoted by the national media. In fact, he was recently asked to be a regular contributor to Forbes!

- Schedulefly

: In 2008, Wes Aiken, Tyler Rullman, and Wil Brawley launched this employee work scheduling software for independent restaurants. Today, more than 6,000 restaurants and hundreds of thousands of their employees use it every day. They’ve also added two more First Research alumni to their technology team.

: In 2008, Wes Aiken, Tyler Rullman, and Wil Brawley launched this employee work scheduling software for independent restaurants. Today, more than 6,000 restaurants and hundreds of thousands of their employees use it every day. They’ve also added two more First Research alumni to their technology team.

- etailinsights: In 2010, Darren Pierce started a sales and marketing intelligence tool designed specifically for online retailers. Today, this business is jamming with hundreds of customers ranging from DHL to Symantec, just to name a few. Did I mention that etailinsights has a fantastic work culture too?

- Vertical IQ: In 2011, Bill Walker, Susan Bell, and I teamed up and launched this company to provide industry profiles to help bankers better-prepare for business calls. Today, we have 130 banks on board, 26,000 users, and the company is growing like a weed.

- Boardroom Insiders:

In 2009, First Research alum Lee Demby helped founder Sharon Gillenwater crank up this tool that provides in-depth information about business executives. Cisco, HP, and Citrix are just a few of its many clients – and the business is growing insanely fast.

In 2009, First Research alum Lee Demby helped founder Sharon Gillenwater crank up this tool that provides in-depth information about business executives. Cisco, HP, and Citrix are just a few of its many clients – and the business is growing insanely fast.

This phenomenon is like the great circle of life, so I must quote the The Lion King, “There’s…more to do than can ever be done…It’s the circle of life, and it moves us all.” So sell your company; just make sure you and your team start new ones – preferably ones experiencing hockey stick growth like these!

How to Negotiate Over-the-top Sales Contracts with Big Companies

“This is a fairly typical ‘big [company] MSA [Master Services Agreement], with lots of overreach and terms that are not applicable to the nature of your services. This is why the issues list is lengthy.”

-Email from my attorney after reviewing a sales agreement with a large company

1-Minute Rant: Product or Marketing? Which Wins Out?

This week’s rant addresses whether having a great product or having great marketing is more important for obtaining fast growth. I have my opinion. Find out my thoughts below! Read More

What’s the Best Age to Start a Startup?

There is no “right” age to start a startup because every situation is different and the skills required to build a startup are wide-ranging. However, that’s only part of the story. Practically speaking, starting at company between 25 and 30 makes good sense. According to my Hockey Stick Research Study, the average age for founders of successful startups age was 32. Another study in the Harvard Business Review reported the average age was just over 31 for founders who were VC-backed and had startups valued at $1 billion or more. Jeff Bezos started Amazon when he was 30. Jack Dorsey launched Twitter when he was 30.

5 reasons that ages 25 to 30 win the battle

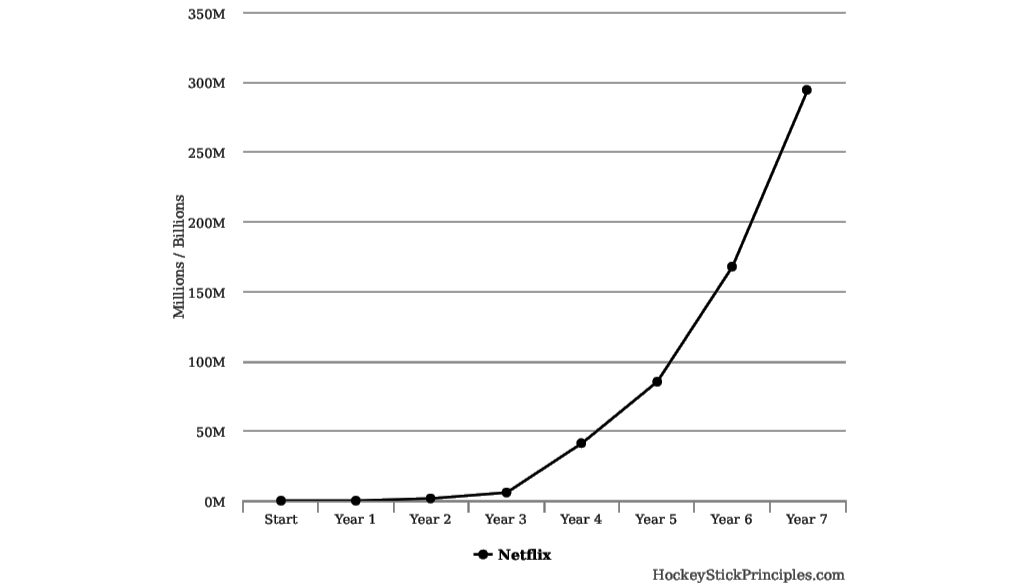

- My Study shows that 25 to 30-year-olds perform better: This chart shows the revenue for 172 successful startups. During the first three years, the 25 to 30-year-olds may have gotten off to slower starts, but they finished much stronger growing to 65 percent larger by their seventh year.

1-Minute Rant: Fast Growth is No Cake Walk!

When I was growing my first company, First Research, from 1999 to 2007 I only sought fast-growth. Before I knew it, I had a company with 30 to 40 employees and multiple departments with their own VPs. Read More

Five Core Attributes of “Investor-Friendly” Founder/CEOs

We’ve all heard the war stories about greedy, pushy, over-the-top, controlling, and uncaring investors. In certain situations, these stereotypes have merit – founder/CEOs need love, not war. But what about investors? Do they need some love too? Read More

What Bruce Springsteen’s Father Taught Me About Entrepreneurship

Singer, songwriter, and winner of 20 Grammys, Bruce Springsteen often wrote songs about his father Douglas’ career. “My dad had a difficult life, a hard struggle all the time at work. I’ve always felt like I’m seeking his revenge,”[1] Bruce recalls. In a separate interview, he lamented, “My father worked a lot of jobs that take everything from you and give you barely nothing back. Some people get a chance to change the world, and other people, they get the chance to make sure the world don’t fall apart.”[2]

The impact of disappointment at work was devastating to Douglas. He would cut the lights off in the house at nine o’clock at night and sit with a six-pack and cigarette. Bruce explains, “… as I got a little older, I’d watch my father, how he’d come home from work and just sit in the kitchen all night like there was something dying inside him, or like he’d never had a chance to live… .”[3]

The “How?” is the Hardest Part

Musician Tom Petty reminds us that “the waiting is the hardest part.” Here is how he went about writing this song that became such a classic with a sharp lesson.

But in entrepreneurship, the waiting isn’t the hardest part; it’s the “how?” that’s the hardest. Read More

How Netflix Obtained Hockey Stick Growth (The Early Years)

Today, Netflix is wildly popular, and it seems just about everyone I know has a subscription. In 2017, it had more than $11.6 billion in revenue, but Netflix, just like many successful startups, started out as an idea hatched from its founder’s frustration. Read More

Luck, Circumstance, Skill or Persistence? Which Leads to Startup Success?

Last week, I shared with MBA students at Georgetown University my research on how founders discovered hockey stick revenue growth. A few of these entrepreneurs focused on one market, working on their entire business model, finding early adopter customers, and building a remarkable brand. One student asked a challenging question: “What about founders who did all those things and still weren’t successful? Did their actions make the biggest difference, or was most of their success a result of luck or circumstance?”

His question really got me thinking. I know founders who showed great skill and patience but who still weren’t successful. In 2006, my friend Tim Horan started Becooz, a website application neighbors use to share profiles, information about service providers, and neighborhood happenings. Becooz is like Facebook-meets-Citysearch—useful for tight circles of neighbors and friends. Local media companies are the primary paying customers because they benefit most from Becooz’s access to targeted advertising.

1-Minute Rant: “How to Mold Your ‘How?'”

As a startup founder, having the opportunity to answer the “HOW?” questions in a way that is specific to the founder’s personality and uniqueness is one of the most rewarding and fulfilling parts of the startup journey. Read More

1-Minute Rant: “Why I Cut-Off My Email”

Let’s face it. Work-life balance is hard. Learn in this week’s Rant how not to get so consumed in the daily grind that you let life pass you by. Be creative, find your balance. I promise you’ll be way happier. Read More

What’s the Deal with the “Carried Interest” in Trump’s Tax Plan?

Why This Tax “Loophole” Could One Day Affect You

On Sunday night, Donald and Hillary debated “carried interest.” Trump and Clinton both said they want to eliminate it. What is carried interest and how does it affect startups? Simply put, on the surface, carried interest is one of the many self-serving-for-rich-people tax loopholes. But let’s dig deeper.

What is carried interest?

Carried interest is a 50-year-old tax provision that allows executives at venture capital, private equity, real estate, and other partnerships to classify much of their income as capital gains. Long-term capital gain (e.g., purchasing an asset for $1,000,000 and selling it for $1,500,000) is taxed federally at 20 percent. Earned income is taxed between 28 and 40 percent.

1-Minute Rant: “Get a Life, Get a Hobby”

I would consider myself a pretty passionate person, especially when it comes to things I enjoy. I am passionate about my startups, my family, hiking, fishing and especially tennis. Read More

1-Minute Rant: When “I Don’t Know” is Just Right

Why, as founders, do we feel the need to put a stake in the ground for what type of company we want to build? Maybe we should consider another approach. I explain why in this week’s 1-Minute Rant. Read More

6 Tips for Nailing Your Pitch

During the past five years, I’ve probably heard 300 founder pitches. No joke. Unfortunately, most founders are very bad at pitching; I’ll be the first to tell you that it’s difficult to do it well. It was 1999, and I’ll never forget my brother-in-law having to step in to clarify to a mutual friend what the heck First Research’s value proposition was. I’m good at some things, but as a pitchman, I’d failed. It was an embarrassing moment since First Research was my idea.

What’s a pitch?

Simply put, your pitch is how you explain your idea to potential customers, investors, and partners. If you suck at it, which most of us do, then few people will be interested in what you’re doing. If you are good at it, you will succeed more often.

Cold Calling Works; I’m Just Sayin’

Cold calling is out of vogue – basically uncool. Marketing and startup pundits bash cold calling as a waste of time and “pushy.” Instead, they say you should pursue partnerships, content marketing, public relations, social media, request referrals, or other cool methods. (By the way, content marketing is really cool!) Read More

6 Reasons Startups are Disappearing

Last week, I discussed that startups are slowly disappearing. The overwhelming question I received from readers was: Why are startups disappearing? Read More

Clarifying the Confusion with Startup Terms

I confess: I’ve spent the past several years confused by terms related to starting a company. Only recently have I begun to understand the nuances between words I hear and read every day. Given that others have told me they are also confused, I figured I’d try to clarify the confusion. Here goes…

Entrepreneurs start and own any type of business. That includes restaurants, home-building firms, decorating firms, law firms, tech firms, retail stores, solo businesses—really any type of company. Merriam-Webster offers this simple definition: “A person who starts a business and is willing to risk loss in order to make money.” So entrepreneurs take on the risk and reward of the enterprise as the owner.

1-Minute Rant: “The Blade Years”

Successful startups experience four stages of growth. The most fascinating stage that is the least attractive and most crucial is “The Blade Years”; the first three years when revenue and growth are low. Read More

1-Minute Rant: How Dare Those Salespeople!

Think carefully about how your salespeople are incentivized. Instead of blaming them for your startup’s problems, we as founders should take a step back – and consider why and where the real problems exist. Read More

What really drives startup revenue growth? The answers may surprise you.

In 2012, tucked away at a cozy table in Global Village Coffee House writing The Hockey Stick Principles, I was plotting the revenue growth curves for a few successful startups. I wondered what factors influenced their revenue growth. So, I searched for studies, and to my dismay, I had little luck. I was looking for answers to questions such as:

- How quickly does revenue typically grow for different types of startups?

- How long does it take for a startup’s revenue to take off and grow faster?

- Does the age of the founder make a difference relative to revenue growth?

- Do startups with multiple founders grow to become larger than those with only one founder?

- Which industries grow revenue the fastest?

Because I couldn’t find what I was looking for, I decided to embark on my own research study.

Four Reasons Every Startup Should Hire College Interns

We have entered a golden era for finding part-time and contract workers! Throughout my years of starting companies, I’ve had the most luck hiring interns. They have offered a higher return on investment than any other investment I’ve made. Read More

The Successful Entrepreneur’s Yin and Yang

In a video documentary about tennis stars Venus and Serena Williams, a film crew followed the sisters throughout 2011, recording how they practice, prepare for tournaments, deal with injuries, and manage their busy day-to-day activities. Read More