A few weeks ago, the Brookings Institute released a fascinating study that shows startups are slowly disappearing. Read and weep:

“Over the past 30 years, new firms have played a decreasing role in the economy and now account for a much smaller share of employment. This reduction is the product of both a reduced startup rate and lower employment levels of the remaining startups. ….In total, firms under the age of 10 made up just 19 percent of employment in 2015, down from 33 percent of employment in 1987.”

This study also points out that the the top four firms in each industry are increasing market share, competition is decreasing, and the rate of investment rate is also declining.

Here are three things we can do to put a stop to these unfavorable trends:

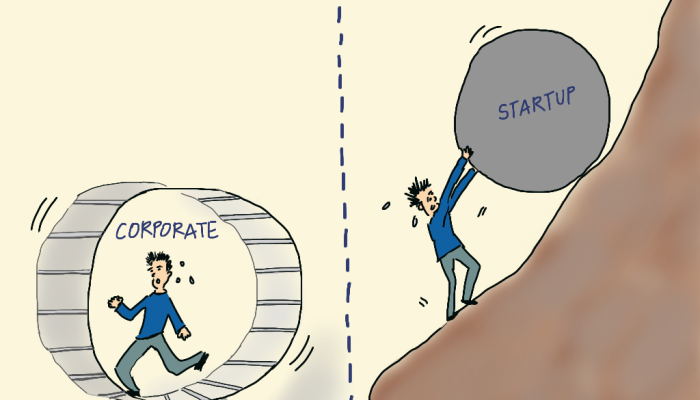

1. Start your own company: According to the Kauffman Foundation, an entrepreneurial think tank, “The Rate of New Entrepreneurs of 0.31 percent means that 310 out of every 100,000 adults became new entrepreneurs in a given month. This number translates into approximately 540,000 new business owners each month during the year.” That number should increase! I meet so many people who tell me that they’d like to start a company but don’t have a good idea. I try to tell them that a great company isn’t often the result of just the idea – that it’s the result of a passionate founder who is dead-set on starting a company. If you have an itch – don’t hold back – go for it and give your company a shot. Remember, you only live once, and if I can do it, I know you can.

2. Don’t believe the “90 percent failure rate” hype: Speaking of starting your own company, don’t believe the rhetoric that you’ll probably fail. In my book, The Hockey Stick Principles, I discuss that an often-quoted statistic is that 90 percent of startups fail. I’ve searched and searched for proof of that, and it isn’t available. Many studies of startup failure rates have been done though, and lots of statistics are available, all of which suggest a significantly lower failure percentage. One widely cited study was performed by Harvard Business School professor Shikhar Ghosh, which the Harvard Business Review described as showing that “75 percent of all startups fail.” I tracked that study down and found that, in actuality, the 75 percent figure is of startups that were backed by venture capital didn’t return the amount of money invested. That’s quite a qualification. Keep in mind: Only one-tenth of 1 percent of startup firms are VC-backed. So, this example, in fact, represents just a sliver of “all” startups.

According to the United States Bureau of Labor Statistics, new firms show about a 50 percent survival rate after five years and a 33 percent survival rate after 10 years. My book discussed several other studies, but these numbers all make one thing clear: Failure is in fact common. But what seems to be the best, rough overall conclusion is that slightly less than half of new businesses succeed. That’s a much better percentage than 10 percent! Conclusion: Your chances of success are much greater than you think – especially companies started by those who have thought through their chances, saved money, and are dead-set on making it work.

3. Show startups some financial love: If your financial situation supports it, invest at least 5 percent of your net worth into startups. My blog “13 Observations from a Part-Time Angel Investor” offers tips and ideas for how to get involved. Personally, investing in startups has been one of my most inspirational and life-giving jobs for me. In addition to direct investments, there are many other options for supporting startups: investing in angel groups, crowdfunding, and connecting founders with investors you know.

Let’s buck the trend. Start a startup today!

Sign up to get more great insights directly to your inbox.

As a special bonus, you'll also immediately get access to my inside analysis of what made 172 diverse companies achieve take-off revenue growth.

I agree, and VC firms actually expect companies to fail and only look for 1-in-ten survival, and allow the others to burn through cash and then they sell them off or piece meal them out, sell the IP, assets, and move on. Doesn’t mean it would have failed if the entrepreneurs didn’t utilize the VC, had they had an angle investor, or their own money, they most likely would have been more diligent, better operators, less wasteful. I will read your book and honestly review it online, if you’d like to send me a copy. Lance

Good point Lance. Thanks for checking out The Hockey Stick Principles. It covers a lot of the topics you discuss.

Fascinating statistical analysis here. Could it be that success is dependent less on any given variable, and more on the sum of its parts as a whole i.e founders, timing, idea, AND financial status? I’ve been having lots of conversations about this in regards to the startup I founded, Loopie (think Uber but for laundry) and don’t believe I know, or will ever be capable of knowing the definite future trajectory, of this startup, afterall there will always be risk, success is never gauranteed but I figure as a founder it’s best to stay true to yourself, your vision and continue on as best you can….

Hi John, Thanks for the input and well-thought out ideas. I agree! Success is in the eye of the beholder.