Today, Netflix is wildly popular, and it seems just about everyone I know has a subscription. In 2017, it had more than $11.6 billion in revenue, but Netflix, just like many successful startups, started out as an idea hatched from its founder’s frustration.

Here is how Netflix was created.

In 1996, Reed Hastings, Netflix’s founder and still its CEO, who was a former math teacher and software entrepreneur, came up with his idea after facing his wife’s wrath when competitor, Blockbuster, fined him $40 for returning a movie rental late. He knew there had to be a better way to rent and enjoy videos. “I mean it was just crazy,” Reed explained in a 2009 CBS 60 Minutes interview. “. . . I was on the way to the gym and I realized – ‘Whoa! Video stores could operate like a gym, with a flat membership fee.’ And it was like, ‘I wonder why no one’s done that before!’”[i]

In 1996, Hastings was tinkering with his idea, but the basic concept itself wasn’t the only critical factor that made Netflix successful. From 1996 to 1999, during Netflix’s “blade years,” Hastings was trying to figure out the best business model—in essence, looking for the best particular idea within the general idea. At first, he charged per rental, as had been the Blockbuster model. This led Hastings to make a gutsy move. Despite the fact that his current business model was ultimately working, he decided to make a substantial change because he thought he could get better growth.

Hastings switched to a subscription model, a radical idea at the time, as he recounted with CNN Money:

“Early on, the first concept we launched was rental by mail, but it wasn’t subscription-based, so it worked more like Blockbuster. Some people liked it, but it wasn’t very popular. I remember thinking, God, this whole thing could go down, and we said, ‘Let’s try the more radical subscription idea.’ We knew it wouldn’t be terrible, but we didn’t know if it would be great. We launched the service on Sept. 23, 1999, and we could tell within a month that we had a renewal rate. It was a free trial, but only 20 percent didn’t go from the free trial to the paid. We’re up to 90 percent renewal now.”

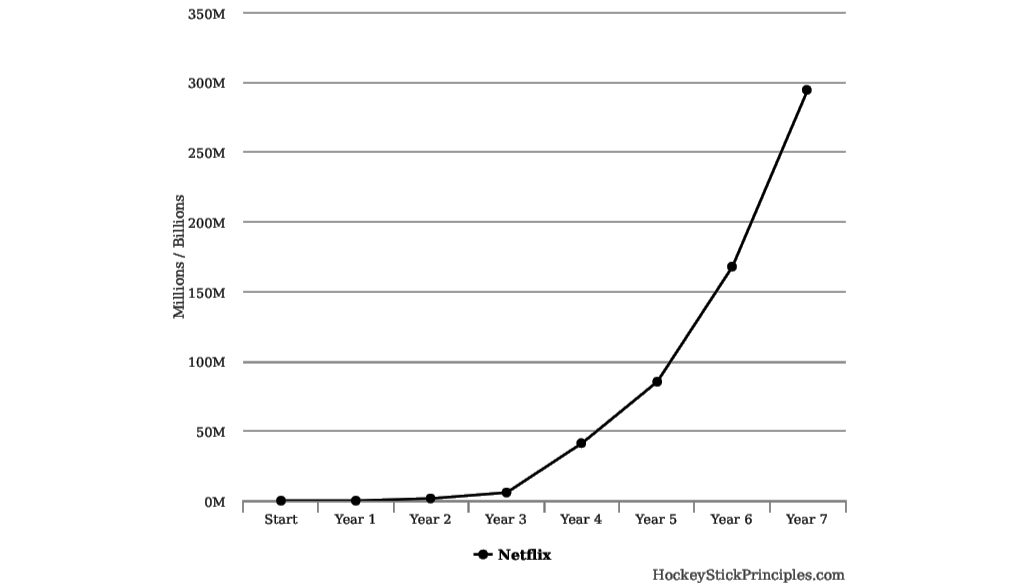

That early revenue of $1.2 million turned out to be paltry by comparison to the $431.2 million the company made just two years later, let alone the more than $11 billion it earned in 2017.

If You Desire Hockey Stick Growth, Consider Tweaking Your Business Model

One main takeaway from Netflix’s early story is that Hastings didn’t immediately know how to best implement Netflix’s best business model. Instead, he needed time (three years) to adjust his business model to find one that really worked well.

How might this apply to your own startup? For starters, even after three years of some success, Hastings didn’t settle and continue trying to grow a business model that was working out just fine. Instead, he had the guts to abandon it and try one that he felt could work better. Too many founders, myself included, are afraid to take even greater risk after something is working—even if it’s working just up to par. You can settle, but if you do, you could miss out on an even bigger opportunity.

Here are some additional nitty-gritty details of Netflix’s hockey stick growth.

Tinkering/Pre-Start (Pre-1997)

- Reed Hastings comes up with basic subscription/membership concept after receiving a late fee at Blockbuster.

The Blade Years (1997-2000)

- Hastings and Marc Randolph launch NetFlix.com, Inc., in August of 1997 in Scotts Valley, California.

- Hastings supplies startup cash ($2.5 million) from selling his first company, Pure Software.

- April 14, 1998: Opens for business; 30 employees, less than 1,000 DVD titles for rent.

- Operates like Blockbuster, except rental by mail.

- September 1998: Sells 10,000 copies of Bill Clinton’s grand jury testimony for $0.02 each; gains media coverage.

- December 1998: Announces will stop selling DVDs; directs customers to Amazon.com in exchange for publicity on Amazon’s site.

- January 1999: Partners with All-Movie Guide to direct movie title searches to NetFlix’s website.

- July 1999: Obtains $30 million investment from Group Arnault.

- September 23, 1999: Launches subscription service.

The Growth Inflection Point (2000)

- Year 4 growth inflection point: $41,237,464 revenue (grew 607 percent from 1999).

- Introduces CineMatch recommendation tool that compares rental patterns among customers and aligns tastes.

- December 2000: Runs first television ads.

Surging Growth (2001-2003)

- 2001: Loses $21.1 million for the year, even with a doubled monthly subscription rate.

- 2001: Signs contract with BestBuy that provides wider audience.

- February 2002: Attains 500,000 subscribers.

- 2002: Becomes Netflix, Inc. (changes the ‘F’ to ‘f’).

- May 29, 2002: Sells 5.5 million shares in IPO of common stock for $15/share.

[i] http://www.cbsnews.com/8301-18560_162-2222059.html

Sign up to get more great insights directly to your inbox.

As a special bonus, you'll also immediately get access to my inside analysis of what made 172 diverse companies achieve take-off revenue growth.